Are Tap-to-Pay Stickers at Gas Pumps a Scam?

Here’s What You Should Know.

Every day, scammers devise new ways to trick consumers. With constant text messages, social media posts, and viral videos fueling fear, it’s challenging to separate fact from fiction. A recent video circulating online sparks concerns about tap-to-pay stickers at gas stations. For years, experts have warned consumers about fraud tactics, such as skimming devices hidden in card readers.

A key tip: check the tamper-evident seal on the pump. If the seal is broken or missing, the pump may have been compromised.

What about the focus on the sticker itself?

According to Google’s AI Overview,

“Stickers placed over tap-to-pay devices at gas pumps are generally legitimate, not a scam. They are often replacement stickers used by gas stations to maintain visibility of payment options, not to steal data. While the circulation of these stickers online has sparked fears of a scam, officials have clarified that the stickers are typically standard industry replacements for worn-out or damaged terminals.”

In other words, most of these stickers are harmless. However, if you notice the tap-to-pay option isn’t working, and the chip reader also fails, it’s best to go inside the store to complete your transaction. Avoid swiping your card, as the magnetic stripe is more vulnerable to skimming devices.

Red Flags: Watch out for stickers promoting a QR code or mobile payment apps, such as Venmo. They are not part of standard pump hardware and should be reported to the station attendant immediately.

Is tap-to-pay the safest option?

Yes. A recent ATMIA (ATM Industry Association) article cited the Financial Crimes Intelligence Center (FCIC) in Tyler, Texas, confirming:

“While we all need to stay vigilant as criminals become more savvy, there are no legitimate instances reported where ‘tap-to-pay stickers’ have been used to steal data,” said Jeff Roberts, FCIC Intelligence Operations Captain.” The article continues to say "tap-to-pay option at fuel pumps, especially when using a payment app, remains the safest method.”

Here's why: Tap-to-pay cards use a small chip and antenna to communicate with payment terminals using radio frequency identification (RFID) or near-field communication (NFC) technology. These systems don’t transmit the actual cardholder’s account number. Instead, they use tokenization, which turns sensitive data into a unique, encrypted code that protects your information during wireless transmission. This makes tap-to-pay one of the most secure payment methods available.

The bottom line.

In today’s digital world, where misinformation spreads quickly, staying informed and cautious is your best defense.

-

Learn how tap-to-pay works

-

Inspect the pump before paying

-

Avoid using the magnetic stripe

-

Report anything that seems off

Stay smart, stay secure!

Have questions about secure payment options? Contact us today.

Follow us for more payment safety tips and share this article to help others pump with confidence.

July 4th, Federal Holiday Banks Closed

Let freedom ring! This is a friendly reminder that July 4th is a Federal Holiday. The Banks will be closed on Friday, July 4, 2025; therefore, there will be no Deposits. Deposits will resume on Monday, July 7, 2025. CCG wishes everyone a safe 4th of July.

Let freedom ring! This is a friendly reminder that July 4th is a Federal Holiday. The Banks will be closed on Friday, July 4, 2025; therefore, there will be no Deposits. Deposits will resume on Monday, July 7, 2025. CCG wishes everyone a safe 4th of July.

Did you know?

Adams & Jefferson both died on July 4, 1826—exactly 50 years after the Declaration.

The Star-Spangled Banner was written in 1814, during the War of 1882, by Francis Scott Key, who was inspired by a flag that was still flying after the battle. The melody was set to a British song called "To Anacreon in Heaven."

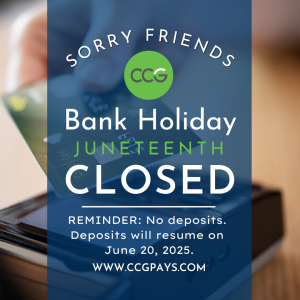

Banks Closed Federal Holiday

This is a friendly reminder that Juneteenth is a Federal Holiday, and the Banks will be closed on Wednesday, June 19, 2025. Therefore, there will be no Deposits on June 19, 2025. Deposits will resume on June 20, 2025.

Did you know?

In 2021, Juneteenth was officially recognized as a federal holiday, making it the 12th legal federal holiday in the United States. A day to reflect on the history of slavery, the struggle for freedom, and the ongoing fight for racial equality.

CCG discusses Merchant Services on Radio Worcester

On Radio Worcester, Hank Stolz spoke with Keith Reardon from Commonwealth Consulting Group and Megan MacBride from the Better Business Bureau. They talked about what merchant services are and how being accredited by the BBB can help a business grow. They also shared details about the partnership between CCG and the BBB for credit card processing.

Commonwealth Consulting Group has successfully assisted businesses throughout the Commonwealth, as well as out of state, with reliable Payment and ATM solutions. Check it out here!

On-site ATM will boost customer satisfaction

As a business owner, you're always looking for ways to increase revenue and attract more customers to your establishment. One often overlooked option is installing an ATM on your premises. The benefits are clear with our free full-service ATM placement program.

First and foremost, having an ATM on site will make it more convenient for your customers to access cash. Studies show that customers are more likely to spend money at a location with easy access to an ATM, as they don't have to go out of their way to find one elsewhere. This can lead to increased foot traffic and sales for your business.

Furthermore, by partnering with us, you won't have to worry about the maintenance of the machine or filling it with cash. We take care of everything, including repairs and restocking the ATM with cash, so you can focus on running your business.

Another advantage of having an ATM on site is that it can help reduce credit card processing fees. Customers who have access to cash may be more likely to pay with cash instead of credit cards, saving you money on transaction fees.

Lastly, having an ATM on your premises can improve the overall customer experience. It shows that you're invested in making it easy for customers to shop at your business and provides a sense of convenience and accessibility. This can increase customer loyalty and positive word-of-mouth marketing for your business.

In conclusion, installing an ATM through our free full-service ATM placement program can be a simple yet effective way to boost your business's revenue and customer satisfaction. So why not take advantage of this opportunity and contact us today to see how we can help you bring an ATM to your business.

Your Customers Will Thank You, and So Will Your Wallet!

Auto bodies and auto repair shops, like any other business, face several challenges when it comes to managing their finances. One of the biggest is balancing the books while keeping customers happy. One solution to this challenge is the use of a cash discounting system.

A cash discounting system allows auto repair shops to offer customers a discount on the total cost of their repair if they pay in cash. This can help increase sales and reduce the time and resources required to process payments. Additionally, it can help improve customer loyalty, as customers will appreciate the savings offered by a cash discount system.

Another benefit of using a cash discounting system is the reduction of processing fees. When a customer pays with a credit or debit card, the auto repair shop must pay a fee for each transaction. These fees can add up quickly, especially for a busy shop with many customers. The shop can reduce or eliminate these fees by offering a discount for cash payments and keeping more money from each transaction.

The use of a cash discounting system can also help to simplify the accounting process for auto repair shops. The shop will have fewer transactions to record and reconcile by processing fewer credit and debit card transactions. This can free up time and resources that can be used to focus on other important aspects of the business, such as customer service and marketing.

In addition to these benefits, a cash discounting system can also help to promote a positive image for the auto repair shop. By offering customers a discount for paying in cash, the shop can show that it values the customer's business and is willing to go the extra mile to make their experience as positive as possible. This can lead to increased customer loyalty and higher levels of repeat business.

In conclusion, auto repair shops should consider using a cash discounting system. By offering customers a discount for paying in cash, they can increase sales, reduce processing fees, simplify the accounting process, and promote a positive image for the business. All of these benefits can help the shop to thrive and grow in an increasingly competitive marketplace.

Searching for a new point of service system?

Everybody knows you can’t run a retail business without a reliable point of sale (POS) system. It’s the driving force behind all the rest of your business operations. But, not all POS systems are the same, so it’s important to choose the right one. One of the many free services we offer at Commonwealth Consulting Group is to sit down with you, evaluate your needs, compare options, and help you select the system that gives you the best features at the right price.

What is a POS system?

In its simplest form, a cash register or cash drawer could be classified as a point-of-sale system. But, contemporary point-of-sale systems are a combination of hardware and software tools used to process your credit and debit card transactions and cash sales with retail customers.

A POS may be a physical device in a brick-and-mortar store or a checkout point in a web-based store, so transactions, including cloud-based transactions, may take place in person or online, with receipts shared either in print or electronically.

POS systems are increasingly interactive, particularly in the hospitality industry, allowing customers to make reservations, view menus, place orders, pay bills, and apply tips electronically.

Meanwhile, point-of-sale software devices allow the merchant to monitor inventory and buying trends, track pricing accuracy, and collect marketing data.

How can we help?

Are you considering moving away from your present cash register system to a fully integrated point of sale system, or upgrading an existing POS? Give us a call at (800) 866-3944, or Email us at inquiry@ccgpays.com and we’ll set up a convenient time to go over your options.

Here’s a Way to Keep More of Your Profits and Grow Your Business

For the past dozen years or so, Commonwealth Consulting Group has been supporting businesses with the credit card processing equipment and services they need to be successful, so we know what every business owner knows: accepting credit cards leads to increased sales. But we also know that means our customers have to bear the cost of maintaining a merchant account and processing credit card transactions. That comes with hefty fees that eat into your profits.

What if we told you there is a way to satisfy your customers who enjoy the convenience of using their credit card and still pay less for processing credit card transactions so you can keep more of your profits

Welcome to cash discounting! A cash discount program offsets the cost of credit card processing fees by encouraging customers to pay in cash. When a customer chooses to pay in cash, your system applies a small discount of up to 4% to the product or service price. Customers love a good discount, and there is no easier way than this – they simply have to pay with cash.

If the customer opts to pay with a credit or debit card, our upgraded POS terminal calculates and includes the card processing fee for the transaction. The customer receipt clearly displays the adjustment for not opting to pay with cash and receive the discounts. This message is reinforced with a sign displayed at your register informing your customer that if they pay with cash, they are afforded a discount. If they choose to pay with a credit card, the discount will not be applied.

It’s important to understand that a cash discount is not the same as a credit card surcharge, where the cost of processing is added to the regular price at checkout if the customer uses a credit card. Cash discount programs are legal in all U.S. states and territories as long as all compliance requirements are met.

That’s where Commonwealth Consulting Group comes in. We can help you implement a fully compliant cash discount program. With our free POS terminals and upgraded software, credit card processing fees will be included in the transaction when your customers pay with a credit card. We can also provide you with the required signage to display at your register and inform your customers of their options.

Interested? Let’s chat.

We’d love to tell you more about how other CCG customers are already using the simple, clear payment solutions we can provide. Give us a call today at 800.866. 3944, or email us at info@ccgpays.com and we’ll get you started saving money on your monthly credit card processing fees.

Seasonal ATMs? Yeah, we can do that!

It's September, a time when lots of seasonal activities start to fill our calendar! Back-to-school haircut? Check. A visit to the pumpkin patch? Check. Apple picking at the orchard down the road? Check. Visit to the farm stand? Well, you get the idea.

And if you're one of those merchants who experiences an increase in business around this time of year, or maybe you even do most of your business in the fall or winter, you don't want a lack of available cash to chase away potential customers! Commonwealth Consulting Group is here to help.

No matter what your need for a temporary ATM, give us a call at (800) 866-3944 and we'll have you – and your customers – plugged into an ATM in no time!